Speciality chemical manufacturer Survival Technologies has filed preliminary papers with markets regulator Sebi to mop up ₹1,000 crore through an Initial Public Offering (IPO).

The IPO comprises a fresh issue of equity shares aggregating to up to ₹200 crore, and an Offer For Sale (OFS) aggregating to up to ₹800 crore by its promoters and promoter group shareholders, according to its Draft Red Herring Prospectus (DRHP).

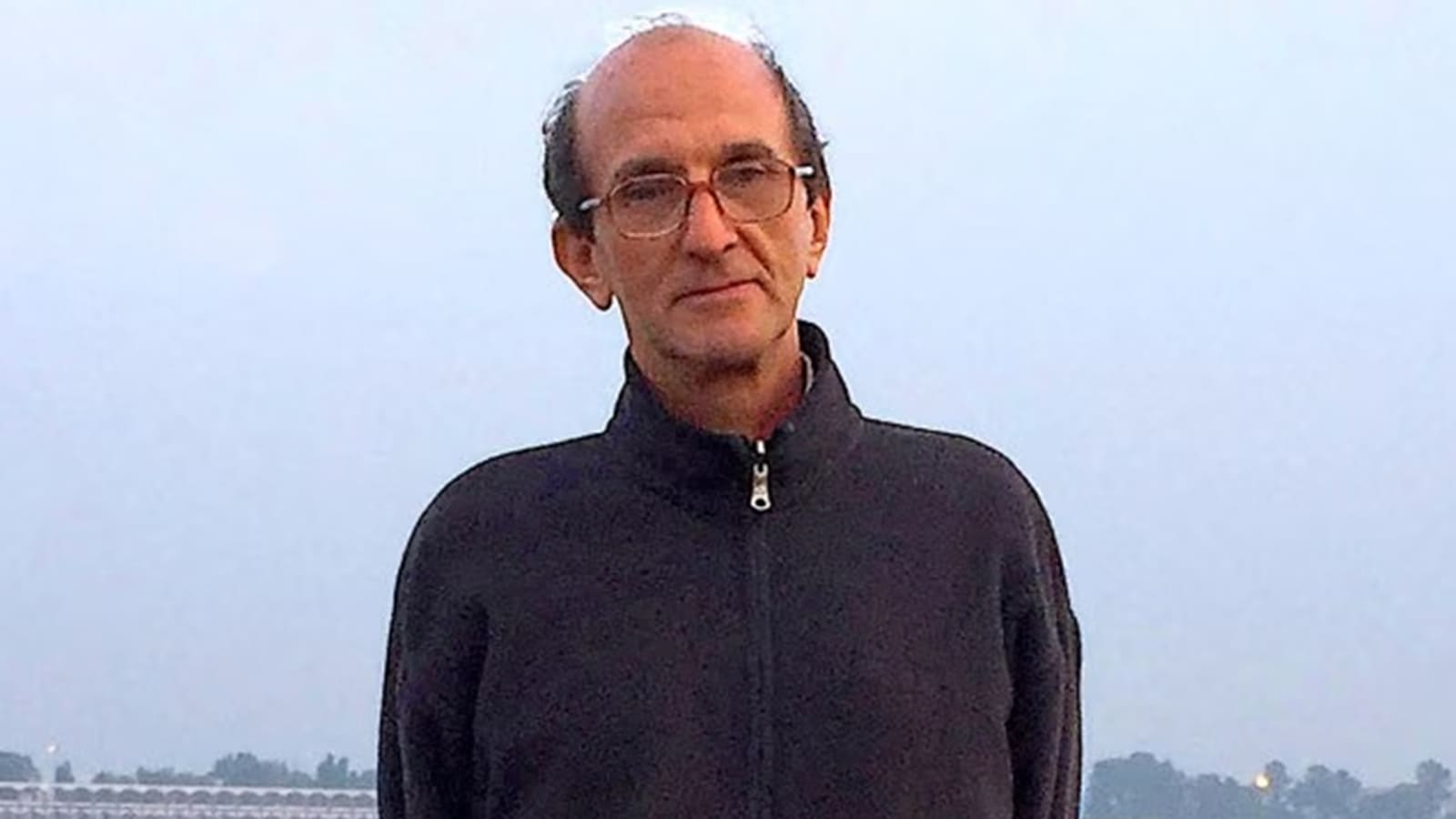

The OFS will see the sale of shares to the tune of ₹544.41 crore by Vijaykumar Raghunandanprasad Agrawal, ₹212.41 crore by Nimai Vijay Agrawal and ₹43.18 crore by Prabha Vijay Agarwal.

Going by the draft papers, the company may explore a pre-IPO placement. If such a placement is undertaken, the size of the fresh issue will be reduced.

Proceeds from the issue worth ₹175 crore will be utilised towards funding the working capital requirements of the company and other general corporate purposes.

The Mumbai-based firm is a Contract Research And Manufacturing Services (CRAMS) focused speciality chemical manufacturer in India. It is one of the few speciality chemical manufacturers in India manufacturing select products from the heterocyclic and fluoro organic product groups for sale in domestic and in international markets.

For financial year ended March 2022, the company’s profit after tax stood at ₹73.46 crore, whereas its revenue from operations rose to ₹311.78 crore in FY22, as compared to ₹274.79 crore in the previous fiscal.

JM Financial and ICICI Securities Ltd are the book running lead managers to the issue.

The equity shares are proposed to be listed on both the bourses — NSE and BSE.