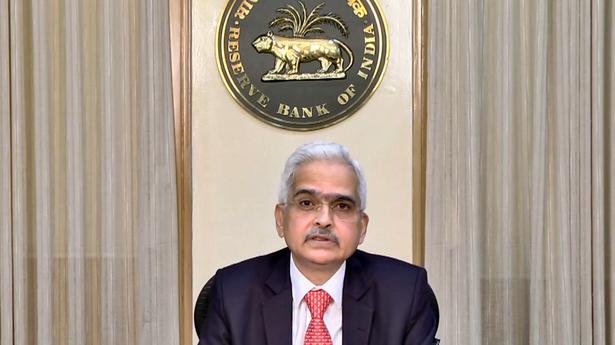

The Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) on Wednesday voted unanimously to increase the policy repo rate by 50 basis points to 4.90%, with immediate effect towards its stance in rolling back the ultra accommodation that was necessitated to deal with the impact of the pandemic.

Consequently, the standing deposit facility (SDF) rate stands adjusted to 4.65%; and the marginal standing facility (MSF) rate and the Bank Rate to 5.15%.

The MPC also decided unanimously to remain focused on withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth, RBI governor Shaktikanta Das said while announcing the rate hike.

He said the real GDP growth for 2022-23 has been retained at 7.2%, with Q1 at 16.2 per cent; Q2 at 6.2%; Q3 at 4.1 %; and Q4 at 4.0%, with risks broadly balanced.

With the assumption of a normal monsoon in 2022 and average crude oil price (Indian basket) of US$ 105 per barrel, inflation is now projected at 6.7% in 2022-23, with Q1 at 7.5%; Q2 at 7.4%; Q3 at 6.2%; and Q4 at 5.8%, with risks evenly balanced.

Around 75% of the increase in inflation projections can be attributed to the food group. Further, the baseline inflation projection of 6.7% for 2022-23 does not take into account the impact of monetary policy actions taken today, he said.

Between February and April, headline inflation has increased by about 170 basis points.

“With no resolution of the war in sight and the upside risks to inflation, prudent monetary policy measures would ensure that the second-round effects of supply side shocks on the economy are contained and long-term inflation expectations remain firmly anchored and inflation gradually aligns close to the target,” he said.

The monetary policy actions including withdrawal of accommodation will be calibrated keeping in mind the requirements of the ongoing economic recovery, Mr Das said.

In his monetary policy statement governor Das said, “The war in Europe is lingering and we are facing newer challenges each passing day which is accentuating the existing supply chain disruptions.”

“As a result, food, energy and commodity prices remain elevated. Countries across the world are facing inflation at decadal highs and persistent demand-supply imbalances. The war has led to globalisation of inflation,” he said.

Not surprisingly, central banks are reorienting and recalibrating their monetary policies. Emerging market economies (EMEs) are facing bigger challenges from increased market turbulence, monetary policy shifts in advanced economies (AEs) and their spillovers. The process of economic recovery in EMEs is also getting affected, he said

“During these difficult and challenging times, the Indian economy has remained resilient, supported by strong macroeconomic fundamentals and buffers. The recovery has gained momentum despite the pandemic and the war,” he said

“On the other hand, inflation has steeply increased much beyond the upper tolerance level. A large part of the rise in inflation is primarily attributed to a series of supply shocks linked to the war. In these circumstances, we have started a gradual and orderly withdrawal of extraordinary accommodation instituted during the pandemic,” he added.

Mr Das said that the Reserve Bank would continue to be proactive and decisive in mitigating the fallout of the ongoing geopolitical crisis on the economy.

“We have already reprioritised our policies to control inflation, without losing sight of the growth requirements. Our approach underscores a commitment to move towards normal monetary conditions in a calibrated manner,” he said.

“We will remain focused on bringing down inflation closer to the target and fostering macroeconomic stability,” he added.

The monetary policy committee (MPC) voted unanimously to increase rate.

RBI monetary policy highlights

Key lending rate (repo) raised by 50 basis points to 4.9%; 2nd increase in five weeks

Repo rate still remains below pre-pandemic level

Inflation projection for current fiscal raised to 6.7% from 5.7%

Edible oil prices remain under pressure on adverse global supply conditions, notwithstanding some recent correction

Tense global situation imparts considerable uncertainty to domestic inflation outlook

GDP growth forecast retained at 7.2% for current financial year

Economic activity gathering strength; normal monsoon to boost rural consumption

Credit cards to be linked with UPI; RuPay credit cards to be linked first

Lending limits for housing loans by co-op banks doubled

Rural co-op banks permitted to lend to commercial Real Estate – Residential Housing (CRE-RH) sector

Urban Co-op banks allowed to offer door-step banking

e-mandates on cards for recurring payments enhanced to ₹15,000 from ₹5,000