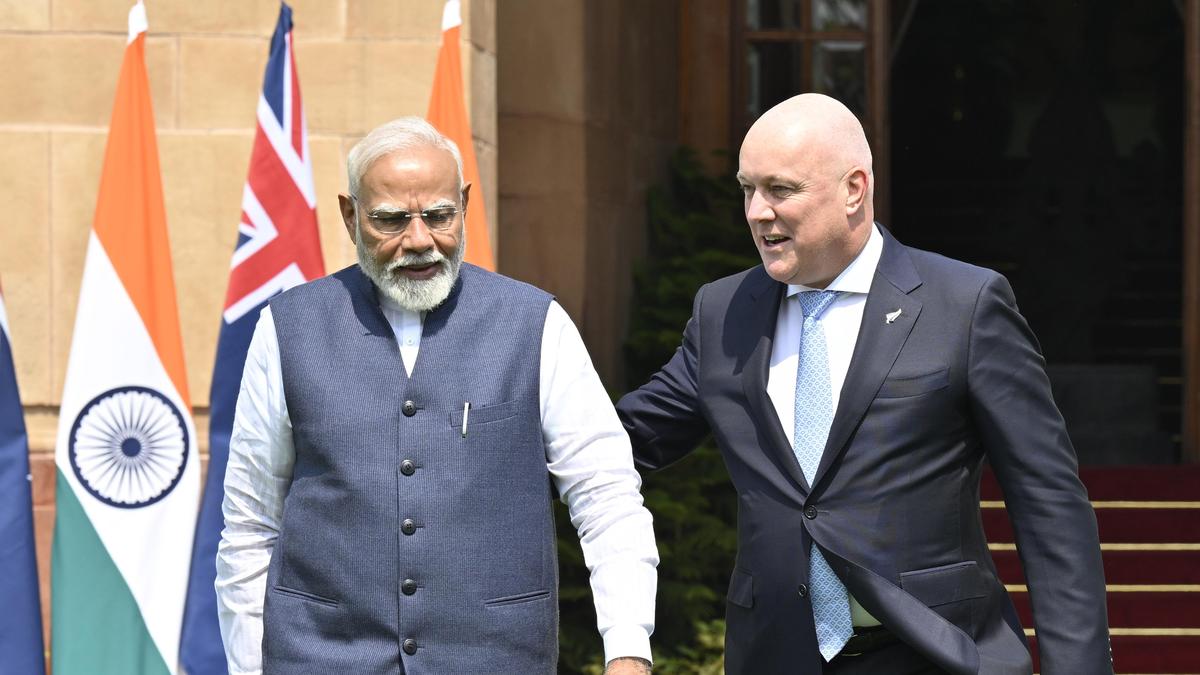

Vijay Shekhar Sharma

| Photo Credit: GRN SOMASHEKARA

Digital financial services firm One97 Communications, owner of Paytm brand, is on the right path to profitability with payments service becoming monetisable, founder and CEO Vijay Shekhar Sharma said on Monday.

While sharing Paytm performance matrix for the month of October, Mr. Sharma said in a letter to shareholders that the company was scaling up lending business which had a huge demand in the country.

“One year ago, we made our way to the public markets. We are aware of the expectations that Paytm carries, and I assure you that we are on the right path to profitability and free cash flows. Our journey to build a scalable and profitable financial services business has just started,” Mr. Sharma said.

The CEO said that the government incentives to UPI payments and merchants’ adoption of Paytm devices and subscription products was making payments increasingly monetisable and profitable.

Mr. Sharma had said during the earnings call said that Paytm’s commerce business continued to operate with profitability as a target and “it has achieved profitability, complete operating full cost loaded profitability.”

The company has posted widening of consolidated loss to ₹571.5 crore in the September 2022 quarter from ₹473.5 crore in the year-earlier period.

The losses of the company had narrowed on a quarter-over-quarter basis.

“After our recent quarterly reports which showed strong operating leverage and reduction in EBITDA (a measure of earnings performance) losses, we are now excited about the next year of our journey, as we get close to EBITDA profitability and free cash flow generation,” Mr. Sharma said.

He said that the company was now scaling up lending business which can bring financial inclusion to hundreds of millions of people in the country.

“Due to the huge demand for lending in our country, our low penetration and the compounding nature of our lending journey, we are extremely optimistic about the prospects of our lending business,” Mr. Sharma said.

In October, Paytm reported loan disbursals at an annualised run rate of about ₹37,000 crore.

The gross merchandise value, which is the total payments made to merchants from the company’s app, grew 42% to ₹1.18 lakh crore in October 2022 from ₹83 lakh crore in October 2021.

The value of the loan disbursed by Paytm grew close to 5 times to ₹3,056 crore in October 2022 from ₹627 crore a year earlier, while volume grew by more than two-fold to 34 lakh loans from about 13 lakh on a year-over-year basis.

The monthly transacting user on its super app grew 33% year-on-year to 8.4 crore, according to the company’s statement.