Between July 1 and Aug. 13, Medisep has paid ₹42.90 cr. in 12,544 claims

Between July 1 and Aug. 13, Medisep has paid ₹42.90 cr. in 12,544 claims

With limited participation of private sector hospitals, Medisep, the medical insurance scheme for Kerala government employees and pensioners, is emerging as a lifeline for pensioners, who constitute around 50% of the population covered by the scheme.

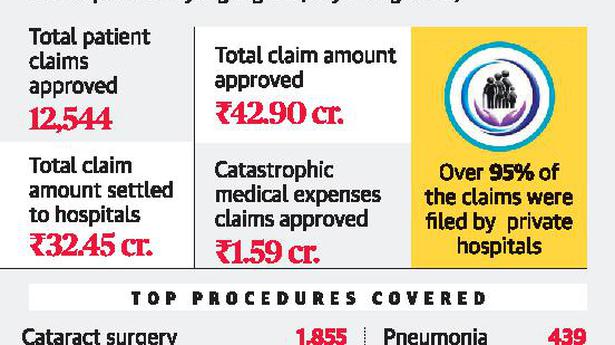

Between July 1 and August 13, Medisep has paid ₹42.90 crore in 12,544 claims, including catastrophic medical expenses.

Senior citizens benefit

Of the claim amount settled, ₹1.59 crore were towards catastrophic health packages. In this short period, over 100 cases of knee joint replacement, 13 cases of total hip replacement, three liver transplants, two cases of renal transplant and one case of bone marrow transplant were covered by the scheme.

The fact that Medisep has been used primarily for cataract surgeries as well as procedures such as knee/hip replacements indicates that the scheme has been beneficial for senior citizens or pensioners.

Till now, pensioners received only a monthly medical allowance of ₹500. For a majority of these senior citizens, private health insurance has remained unaffordable because of the high annual premium charged. Medisep, on the other hand, is offering pensioners comprehensive health coverage regardless of their age or pre-existing illness.

Also read: Medisep scheme will be model for India: Kerala FM

Data points

Data compiled from the Finance department indicates that in 2018-19, there was a budgetary outflow of ₹209 crore to meet the medical expenses of employees and pensioners. This included ₹46.67 crore towards medical reimbursement, ₹150 crore towards medical allowance for pensioners and ₹12.32 crore for interest-free medical loans taken for major medical procedures.

So far, only about 250 plus private hospitals have joined Medisep. Over 50 hospitals (of which 33 are regular hospitals and the rest ophthalmic hospitals) are joining the scheme from August.

Yet, 95.6% of the claims have come from private hospitals, data shows.

“Major private hospitals in Thiruvananthapuram have refused to join Medisep, yet the district figures amongst the top five districts to have submitted most claims. Among government hospitals, Regional Cancer Centre (RCC) and Malabar Cancer Centre (MCC) have filed most claims. Of the ₹42.9 crore of claim approved, we have already settled ₹32.45 crore to hospitals,” sources at The Oriental Insurance Company said.

Fixed premium for a target-group

“Private health insurance is based on risk rating – the premium rates will change according to the individual’s age and risk profile. But Medisep has introduced a unique concept of community rating, wherein the premium is fixed for an entire target group, providing the same benefit and coverage to all, including working employees and elderly pensioners,” Arun B. Nair, a technical expert in health financing, pointed out.

“This innovative feature of Medisep to offer a unified benefit package at a low premium is perhaps the way forward for the future,” he said.