Front running is a market malpractice of trading in securities ahead of large client orders for personal gains.

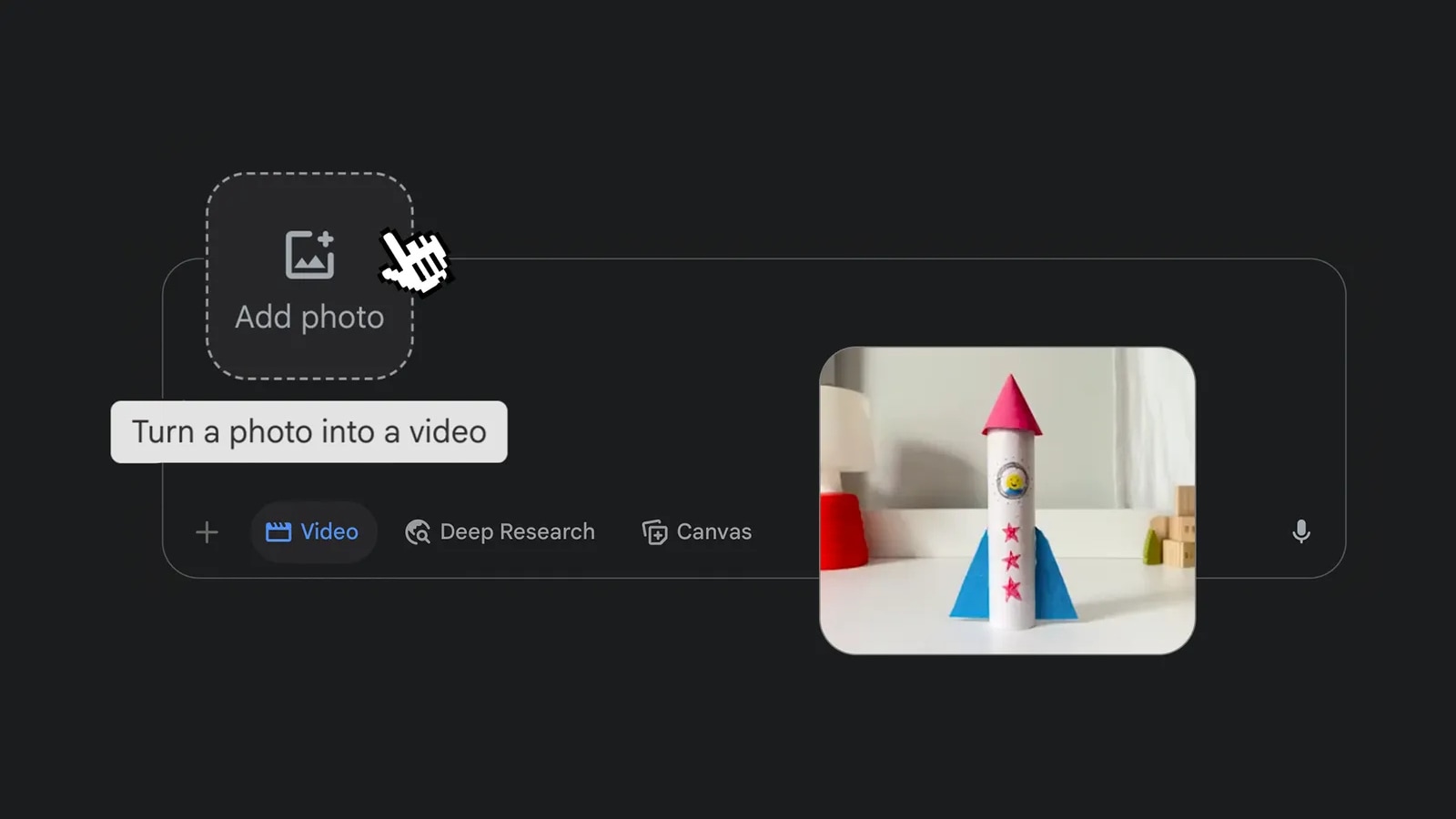

| Photo Credit: FRANCIS MASCARENHAS

India’s market regulator on Tuesday issued interim orders in a case of alleged front-running at Axis Mutual fund, while issuing show cause orders to the mutual fund and related entities.

The Securities and Exchange Board of India (SEBI) directed that 21 entities be barred from the capital markets until further orders.

It identified ₹305 million ($3.7 million) as wrongful gains accrued due to the alleged front-running activities and directed that this amount be impounded from the entities. SEBI has not passed any directions against the fund house and its operations will not be impacted by it.

The regulator conducted a probe in a case of front running in trades of Axis Mutual Fund between September 2021 and March 31, 2022. Front running is a market malpractice of trading in securities ahead of large client orders for personal gains.

“Viresh Joshi, the then chief dealer of Axis MF, was observed to have traded in different securities ahead of the impending orders placed on behalf of the big client (Axis Mutual Fund),” SEBI said in the order.

Email queries sent to the fund house by Reuters and text message sent to Mr. Joshi’s cell number were not immediately answered.

The regulator alleged Mr. Joshi conceived a ‘fraudulent scheme’ in ‘collusion’ with other ‘unscrupulous entities’ to front run trades of Axis MF.

SEBI in its order concluded that it was Mr. Joshi, working as the head dealer, who had the discretion to decide as to when the orders of Axis MF would be placed. Further front-running trades were executed from trading accounts of the entities and persons indirectly connected to Joshi.