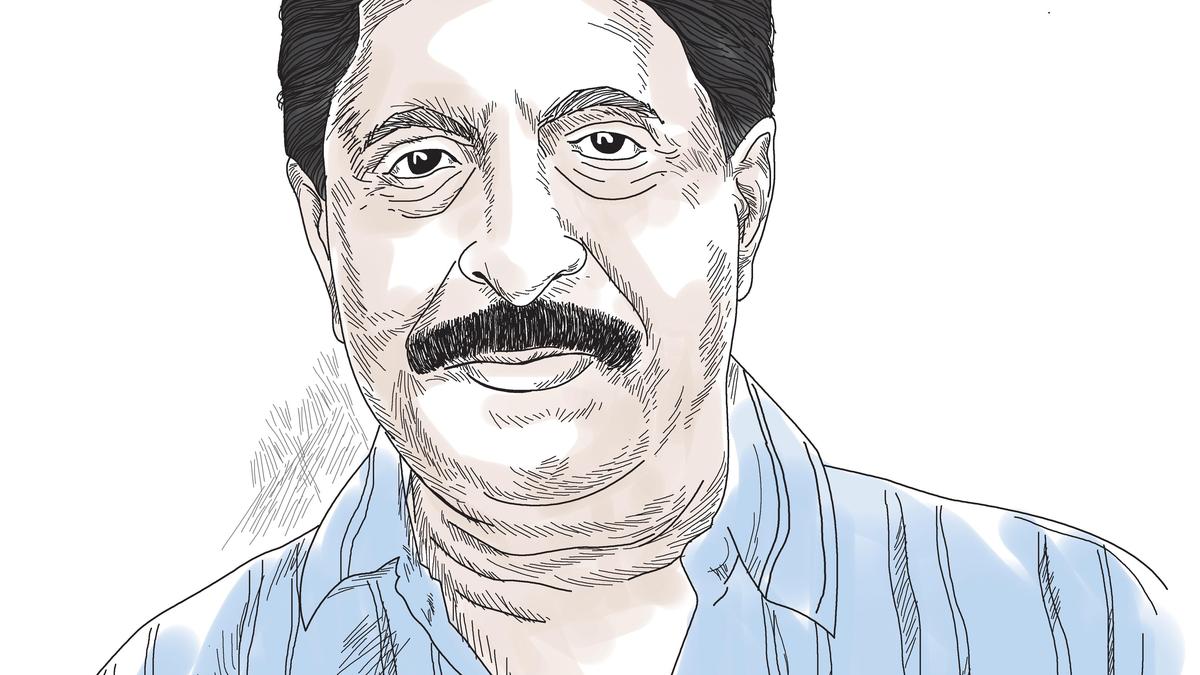

B. P. Kanungo currently serves as a non-executive independent director on the board of IIFL Finance Limited.

| Photo Credit: The Hindu

NBFC firm IIFL Finance has appointed former RBI Deputy Governor B. P. Kanungo as non-executive chairman of the board.

The board at its meeting held on Friday (December 19, 2025) approved Kanungo’s appointment with immediate effect, underscoring its strong confidence in his leadership, independence, and deep regulatory and institutional expertise, IIFL Finance said in a regulatory filing on Friday (December 20, 2025).

Kanungo brings with him over four decades of experience in central banking, monetary policy, and financial regulation, it said.

He served as Deputy Governor of the Reserve Bank of India from 2017 to 2021, and was a Member of the Monetary Policy Committee (MPC).

Mr. Kanungo currently serves as a non-executive independent director on the board of IIFL Finance Limited.

As chairman, Mr. Kanungo will lead the board in setting strategic direction, enhancing governance standards, and safeguarding the interests of shareholders, customers, regulators, and other stakeholders, IIFL Finance Managing Director Nirmal Jain said.

The filing further said the company had received a notice dated October 6, 2025, under Section 158BC of the Income Tax Act, 1961, requiring the filing of a return of income in Form ITR-B for the block period from April 1, 2018, to February 3, 2025, in respect of income required to be reported pursuant to the Income Tax Search.

In compliance with the said notice, the company filed its return of income in Form ITR-B, and paid tax at the applicable rate amounting to ₹1.47 crore.

There is no material impact on the financial, operational, or other activities of the company, it added.

The board also approved the enhancement of the borrowing limit and limit for creation of security on the company’s assets from ₹35,000 crore to ₹60,000 crore, subject to the approval of shareholders.

Published – December 20, 2025 10:53 pm IST