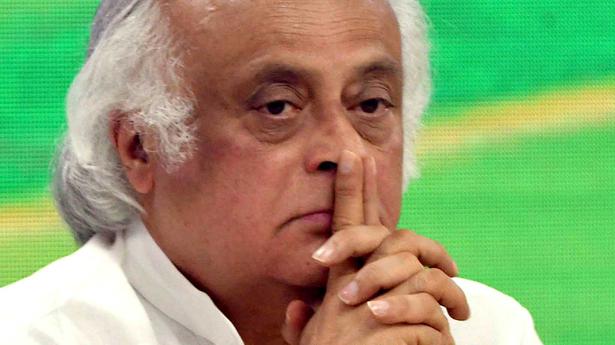

Congress general secretary Jairam Ramesh slammed FM Nirmala Sitharaman over her defence of the hike in GST rates on food items, alleging Modi government is penalising aspiration and a desire to buy more hygienically packed goods.

Congress general secretary Jairam Ramesh slammed FM Nirmala Sitharaman over her defence of the hike in GST rates on food items, alleging Modi government is penalising aspiration and a desire to buy more hygienically packed goods.

The Congress on July 20 said it is “cruel” on the part of the government to raise taxes on some essential items of consumption as it will lead to a further rise in inflation.

Congress general secretary Jairam Ramesh slammed Union Finance Minister Nirmala Sitharaman over her defence of the hike in Goods and Services Tax (GST) rates on food items, alleging the Narendra Modi government is penalising aspiration and a desire to buy more hygienically packed goods.

He said “branded and labelled” is very different from “pre-packaged and labelled”, as the former refers only to products of big companies priced higher and bought by middle and upper-middle classes, while the latter affects small businesses whose products are bought by the lower middle class the poor.

“Above all is the timing. It is cruel to raise tax rates when CPI (consumer price index) inflation is over 7 per cent, WPI (wholesale price index) inflation is over 15 per cent, unemployment is high, the rupee is depreciating, the current account deficit is widening and inflation is expected to rise worldwide,” Mr. Ramesh said in a series of tweets.

“Why should not the poorer consumers aspire to buy pre-packaged and labelled goods,” he posed. In a 10-point response to Ms. Sitharaman’s defence of the hike of GST on food items, Mr. Ramesh said a West Bengal Minister, who attended the meeting, has disclosed it was a virtual one and the State Finance Ministers did not consult each other.

“The West Bengal Minister has also contradicted the Union Finance Minister and said that she and some others opposed the report of the Fitment Committee that recommended the increases,” he said. “Changing its stance, the government and the Finance Minister now use the word ‘consensus’ and not ‘unanimous’,” the Congress leader said. Mr. Ramesh claimed that GST on crematoriums has been increased to 18%.

“Assume there are some input taxes in pre-packaged goods. Was there a demand from producers and sellers to impose a GST on pre-packaged and labelled goods? Not to our knowledge,” he said.

Also read | Government hikes GST for household items

The Congress leader also rhetorically asked why small businesses, shopkeepers and consumers, who are all stakeholders, are complaining about the revised GST rates.

The Congress and other Opposition parties have been protesting the hike in GST rates on items of mass consumption and have stalled proceedings of both houses of Parliament over the issue. They also protested inside the Parliament complex and displayed the essential items of consumption there.