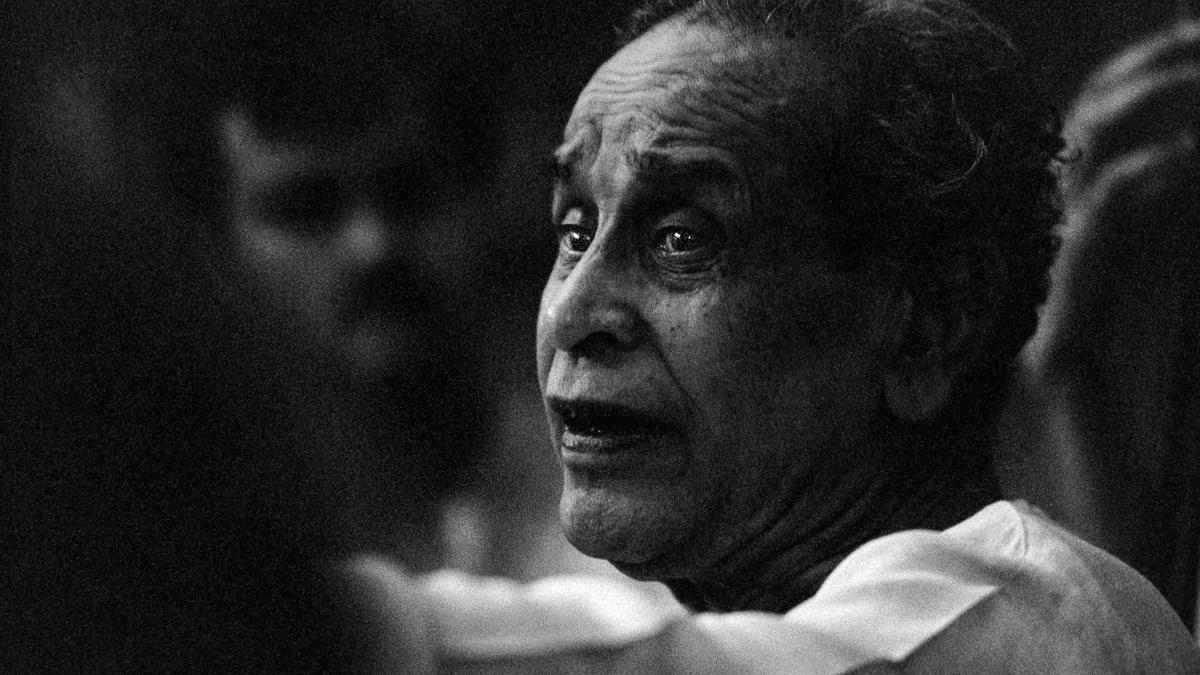

RBI governor Shaktikanta Das announced an additional function for Unified Payments Interface (UPI) platforms that would allow multiple debits. Mr. Das was effusive in his praise for the digital payment system in his address at the conclusion of the three-day Monetary Policy Committee’s (MPC) meeting.

“UPI has emerged as the best payment system anywhere in the world. It has been our constant endeavor to try and deepen the reach in India. The UPI currently includes functionality to undertake recurring payments and single-block payments. It is now being enhanced to allow customers to block funds in their accounts for multiple payments of specific nature,” the Governor said.

This is expected to improve ease of making payments for online shopping and investments in securities. The RBI will introduce single-block and multiple debits functionality that will enable users to block funds in their account

Currently, the UPI AutoPay feature allows users to make recurring payments, but the merchant can make only a single debit to receive payment. With the new feature, the merchant can make multiple debits up to a permitted amount.

UPI is a payment system that allows money transfer between any two bank accounts by using a smartphone. It allows a customer to pay directly from a bank account to different merchants, both online and offline, without the hassle of typing credit card details, IFSC code, or net banking/wallet passwords.