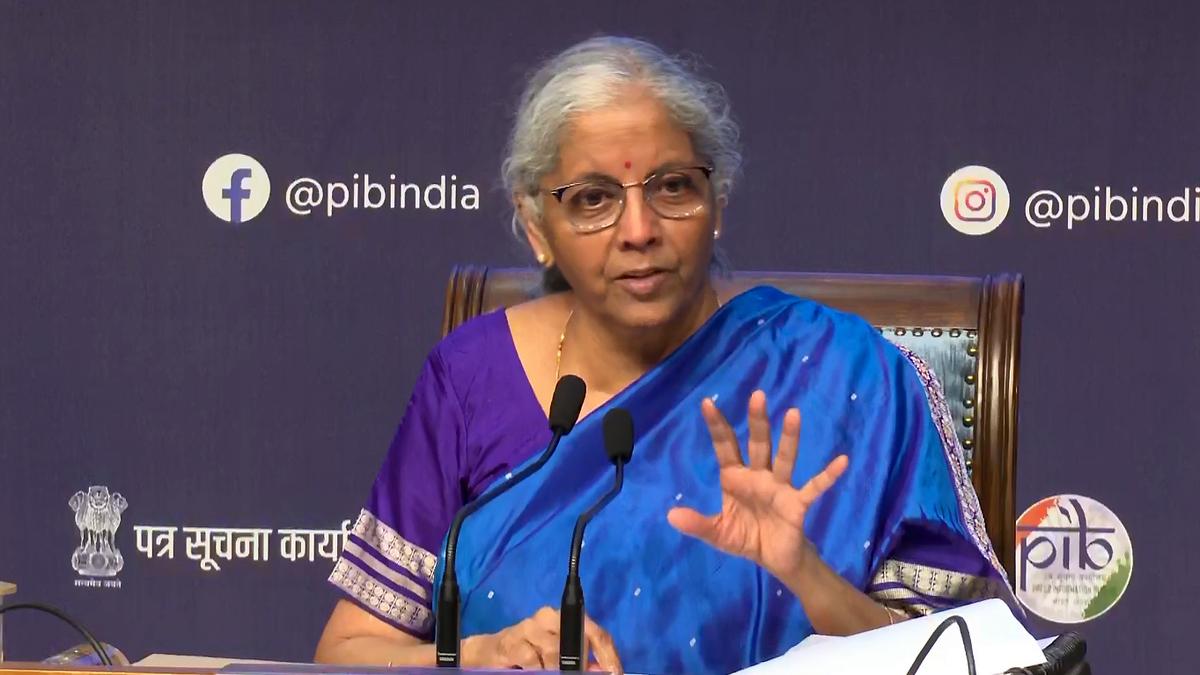

The Goods and Services Tax (GST) Council, during its 56th meeting, decided to revamp the tax structure into a primarily two-rate system as proposed by the Central government, Union Finance Minister Nirmala Sitharaman announced on Wednesday.

She added that the decisions would come into effect from September 22 for most items. Only tobacco and tobacco-related products will move to the new structure at a date to be specified by the Finance Minister.

Apart from the two rates of 5% and 18%, the new GST system would also include a 40% “special rate” on sin goods such as tobacco and luxury items such as large cars, yachts, and helicopters.

The government also calculated that the net fiscal implication of the rate cuts, based on consumption patterns in 2023-24, would be ₹48,000 crore. However, the officials clarified that the real implication would be known on the basis of current consumption, and that the rate rationalisation was expected to result in a buoyancy effect, and improved compliance.

“These reforms have been carried out with a focus on the common man,” Ms. Sitharaman said. “Every tax levied on the common man has gone through a rigorous looking into, and in most cases, the rates have come down. Labour-intensive industries have been given good support. Farmers and agriculture will benefit from the decisions. Health-related sectors will also benefit.”

Rate cuts for common man

She further said that common-use and middle-class items will see a reduction, with products such as hair oil, soap, shampoo, toothbrush, toothpaste, bicycle, table and kitchen ware, and other household articles being moved to 5% from either 18% or 12%.

GST Reforms 2.0: Council approves new rates; Here are the announcements

The Government has reduced GST on several items across different categories. GST reducing rate will be effective from 22th of this month. Briefing the media in New Delhi, Finance Minister Nirmala Sitharaman said that GST on common man and middle-class items has been reduced from 18 per cent or 12 per cent to 5 per cent.

The Finance Minister informed that items such as hair oil, toilet soap, soap bars, shampoos, toothbrushes, toothpaste, bicycles, tableware, kitchenware, and other household articles will now have only 5 per cent GST. She further said that GST on ultra-high temperature milk, chena and paneer has been reduced to zero from 5 per cent, while all Indian breads will now see a nil rate. Ms. Sitharaman also announced that GST on food items such as namkeen, bhujia, sauces, pasta, instant noodles, chocolates, coffee, preserved meat, cornflakes, butter and ghee has been reduced from 12 per cent or 18 per cent to 5 per cent.

| Video Credit:

Businessline

The other items moving down to the 5% rate include namkeens, sauces, pasta, instant noodles, chocolates, coffee, and butter. Twelve specified bio-pesticides, bio-menthol, and labour-intensive items such as handicrafts, marble, travertine blocks, granite blocks, and intermediate leather goods would move from 12% to 5%.

Notably, cement will move from 28% to 18%.

The Finance Minister further explained that items such as ultra-high temperature milk, paneer, and all Indian bread, including rotis, chapatis, and parathas would see their tax rate fall to 0% from the earlier 5%.

Products such as air-conditioners, all TVs, dishwashers, small cars, and motorcycles of engine capacity less than or equal to 350cc would see their tax reduce from 28% to 18%. Buses, trucks and ambulances, as well as all auto parts, would also attract a GST rate of 18%.

The Finance Minister further said that 33 lifesaving drugs and medicines will move from 12% to 0%, while spectacles to correct vision would move from 28% to 5%.

Also read | Who are the members of the GST Council and what is their voting power?

Inversion rectified

“The long-pending inverted duty structure is being rectified for the manmade textile sector by reducing the GST rate on manmade fibre from 18% to 5% and manmade yarn from 12% to 5%,” Ms. Sitharaman said. “That will take care of every anomaly due to duty inversion in this sector.”

The inverted duty structure regarding fertilizers will also be rectified, with the duty on sulphuric acid, nitric acid and ammonia being reduced from 18% to 5%.

The special rate of 40% will apply only on particular sin and super-luxury goods such as pan masala, cigarettes, gutka, chewable tobacco, zarda, unmanufactured tobacco and bidi, as well as goods including aerated water, caffeinated beverages, mid-size or large cars, motorcycles of engines exceeding 350cc, helicopters and airplanes for personal use, and yachts or other vessels for private use.

On insurance services, individual life insurance policies and individual health policies will move to 0% from 18%.

Ms. Sitharaman further explained that the GST rate on pan masala, gutka, cigarettes, chewable and unmanufactured tobacco, and bidi would remain at 28%, in addition to a compensation cess, as currently in place.

Once the Centre discharges the loans it had borrowed to compensate States, these tobacco and tobacco-related items will move to the 40% slab. Ms. Sitharaman said the loan would likely be repaid within this calendar year.

Published – September 03, 2025 10:53 pm IST